Insurance Coverage for Gastric Bypass Surgery

Insurance Coverage for Gastric Bypass Surgery

If you’re considering having weight loss surgery, your first questions may well focus on how you’re going to finance this expensive procedure. Gastric bypass surgery can cost anywhere from $18,000 to $22,000. Fortunately, coverage is now more widely available from insurance companies, both public and private.

Getting your gastric bypass surgery covered by insurance depends on several factors: the state you live in, your employer’s health coverage, and your insurance provider. There are some insurers who will pay for the entire cost of the surgery; others will cover 80% of the costs that have been determined “customary and usual” for this type of weight loss surgery.

In insurance-speak, “usual” refers to the average rate charged for the gastric bypass, and “customary” has to do with the local rates charged by insurers where you live. It’s important to know that these rates are totally arbitrary; in other words, the insurers can set whatever rates they choose. In some cases, patients will be responsible for a co-payment to help cover the gastric bypass surgery. You need to know in advance if you will be covered in the event that there are surgery-related complications.

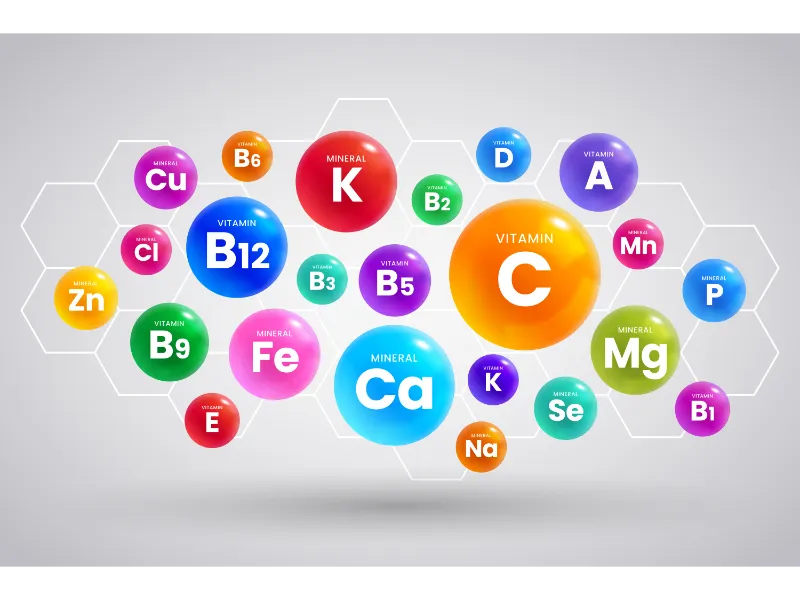

In general, the insurers who cover the cost of the procedure will also be willing to cover a portion or even all of the costs for the numerous expenses, such as the surgeon’s fee, the anesthesia, and the charge for the hospital stay. Some will pay for various post-operative expenses, including diet and exercise plans, any nutritional supplements that you need, and fees for support groups. However, the charges for plastic reconstructive surgeries that many patients want following surgery are usually not covered by insurance. Among these surgeries are body contouring procedures or plastic surgeries such as face lifts, breast lifts, liposuction or panniculectomy.

It is essential that you check with your insurer to learn which additional procedures are covered, and to what extent.

Medicare for Gastric Bypass Surgery

People who are 65 or older, and who have a body mass index (BMI) of more than 35 together with some form of weight-related ailment, are eligible to have Medicare pay for their gastric bypass surgery. Examples of these conditions are Type 2 diabetes, sleep apnea, or heart trouble. To get Medicare coverage, patients must first complete a medically supervised, six-month weight loss program, supervised by a primary care physician or a bariatric surgeon.

In addition, Medicare requires that patients have their weight loss surgery in designated weight loss centers, where the surgeons have performed a specified number of bariatric surgeries. These centers must also have a bariatric team including surgeons, nurses, medical consultants, nutritionists, psychologists and exercise physiologists on hand.

Medicare does not ask that patients be pre-certified prior to being approved for gastric bypass surgery; however, Medicare won’t make the final decision on whether or not to cover your surgery until after the procedure has been performed. To prevent this from happening, talk to your Medicare provider prior to scheduling gastric bypass surgery.

Medicaid for Gastric Bypass Surgery

As for coverage of bariatric surgery by Medicaid – the federal healthcare plan for low-income people – the decisions vary from state to state. If you qualify for Medicaid, you should discuss gastric bypass surgery with a local Medicaid provider.

Private Insurers for Gastric Bypass Surgery

As for private insurers, each company has its own policy on weight loss surgery. The general rule of thumb is that coverage is available for individuals who have a BMI of 40 or higher, or a BMI of 35 or more, together with a weight-related illness.

Companies with more than a few hundred employees are more likely to offer coverage for this type of surgery. Individuals who work for smaller companies with only 100 or so employees are less likely to get insurance for their surgery. Talk to the human resources department of your company to get a better understanding of how much financial assistance is available to you.

Another point to remember is that most private insurance companies don’t approve bariatric surgeries easily – they have requirements that people must meet in order to be eligible. Some insurers ask you to provide a letter that details the medical necessity of the procedure written by your primary care physician, together with documentation of any weight-related ailments you have.

Get familiar with your insurer’s appeals policy when you’re doing research on the financial aspects of your surgery. If your insurer turns you down, you can always appeal. You can also talk to the bariatric program about financing options, but be aware that not all of these options will cover you in the event of post-operative complications.

- BARIATRIC ARTICLES & INFO

Life after Weight Loss Surgery

For those that are overweight and have battled countless hours, days, months, and even years of exhausting weight loss efforts, bariatric surgery has become the last…

About Gastric Sleeve

Gastric sleeve surgery is one of the newest innovations in bariatric surgery. The most important thing to know about gastric sleeve surgery is it is typically used for…

Restorative Obesity Surgery

After gastric bypass surgery, about 17% of patients will begin to gain the weight back within five years. This is mostly due to…